Montgomery School Board Adopts Budget After Divided Community Forum

Nicholas Mistretta

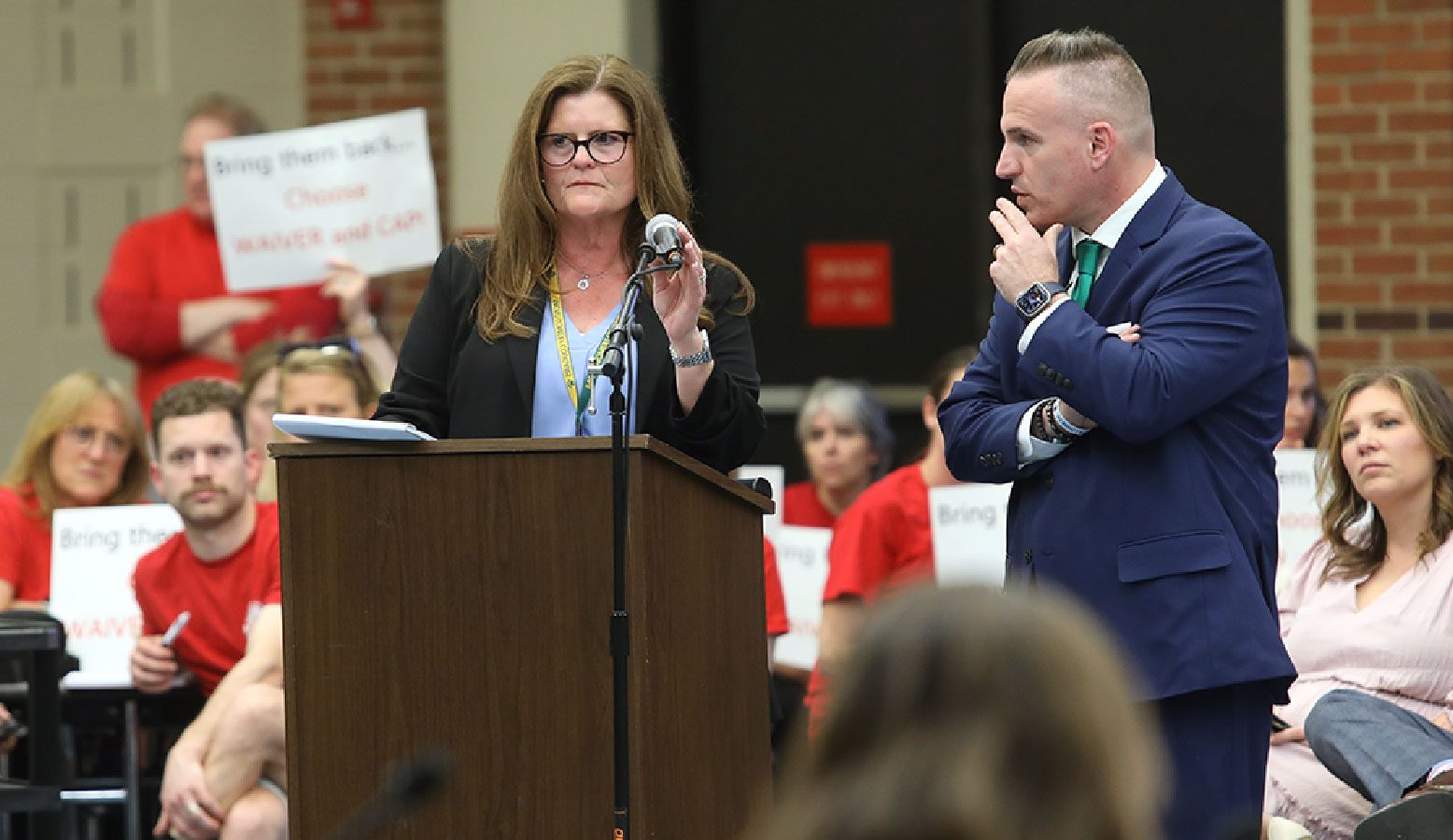

Montgomery Township, NJ — April 30, 2025—In a packed and emotionally charged meeting Tuesday night at Orchard Hill Elementary School (OHES), the Montgomery Township Board of Education faced a contentious showdown over the school district’s budget for the upcoming year.

Teachers, administrators, residents, and union members turned out in large numbers, voicing passionate—and often heated—opinions as the board weighed four proposed budget options that varied in their financial impact and educational consequences.

Four Options on the Table

Business Administrator Andrew Italiano presented the board with four budget paths:

- Option 1: A full 2% tax levy increase—the maximum allowed by the state—plus the entire $2.6 million available from healthcare waiver funds.

- Option 2: An increase exceeding the cap by $1.6 million.

- Option 3: A compromise solution combining the 2% cap increase with an additional $779,863 in banked cap and healthcare waiver funds.

- Option 4: A minimal-impact approach raising the budget only by the standard 2% cap, leaving all waiver funds untouched.

Strong Showings on Both Sides

The Montgomery Township Education Association (MTEA) turned out in full force to support the highest funding levels possible. President Mark Razzoli led the charge during public comment, urging the board to invest in restoring staffing and programs.

“The choice in front of them tonight is simple,” said Razzoli. “You do not have to sacrifice our students’ education. You can instead choose to do what’s right. You can choose to bring these positions back. Vote to use the waiver and the cap.”

Later, during the MTEA report, Razzoli voiced sharp criticism of the board’s deliberations:

“I am blown away by the gross incompetence I have witnessed tonight,” he said, eliciting a mixed response from attendees.

Hope Caldwell a 10-year resident of Sycamore Lane and mother of twin 8th-grade boys shared a personal story about why she chose to make Montgomery her home. “I moved here because of this building we’re in right now—and all the buildings around it,” she said, gesturing to Orchard Hill Elementary School. She offered heartfelt thanks to the teachers and staff who have supported her children over the years. “For my boys to be able to go to high school next year is a true miracle.” She spoke candidly about the impact of previous budget cuts. “Last year, my sons’ occupational therapist lost their job, which put the district out of compliance with their IEP,” she said. “They went without their needed services for two months before it was corrected.” While acknowledging the district’s strengths, she urged the board not to become complacent. “What Montgomery has is a lot—and we are all very fortunate,” she said. “The choice is simple: please vote to increase the tax with Option 1 to support our children. If you don’t vote for this modest increase, it’s clear you do not support our children.”

Jim Meeker a 26-year resident of Roanoke Road spoke about the long-term value of Montgomery’s public schools and the success stories they have helped create. “The reason people move here is because of these schools,” he said, recounting how many of the district’s graduates he knows have gone on to do great things. “In my opinion, that success is due to the education they received from all the people in this room,” he added, gesturing toward the teachers in attendance. He shared his personal connection to the district, noting that his daughter is both a proud graduate and now a 14-year faculty member, with two additional family members also working in the district. “I support them fully,” he said. “My recommendation, like many others in the room, is Option 1.”

But not all voices supported the additional spending. Several residents spoke in favor of a more cautious approach to the budget, urging the board to weigh the impact on local taxpayers.

One Cherry Brook Drive resident shared her personal experience with financial strain, stating, “I do not believe cutting staff’s salaries or benefits is the answer. We need to be fiscally responsible. We need to think hard about the resources we have. Increasing the taxpayer portion cannot be the first and only answer.”

Resident and local Realtor Shannon Shen highlighted the impact of Montgomery’s tax rate on housing decisions. “We live in a great area—the Princeton region,” she said. “All the schools are good: Princeton, West Windsor-Plainsboro, Hillsborough, Hopewell. But then you look at the tax rate, and Montgomery is the highest.” She shared comparative figures to illustrate her point: “Princeton is at 2.663, Cranbury 1.8, Hillsborough 2.0, Bridgewater-Raritan 1.9, West Windsor-Plainsboro 3.065—and Montgomery is 3.376.” She explained that these numbers matter to buyers. “When a client loses a job, they call me looking to relocate to a lower-tax area. When people get older, they often find they can’t afford to stay and have to move out.”

Resident Wei Wu, introducing himself as an economist by trade, brought a different perspective. “Where I come from, education is a priority in family,” he said. “But is it true that the more money we spend, the better the school? That hasn’t proven true in surrounding counties.” He reflected on how Montgomery’s schools ranked number one or number two when he moved into town and how over time despite rising taxes they have declined. “I’m not against the proper way to spend. We should consider the efficient way to spend,” he continued. “Of course, we should consider the students and teachers—but we must also consider the taxpayer.”

Board Settles on a Middle Ground Following extensive discussion, the board ultimately moved past Options 1 and 2, which did not receive sufficient support and approved Option 3. Board members Dowling, Filak, Nargund, Spina, and Todd voted in favor, Jernigan the lone no vote with members Franco-Herman, Harris, and Wang abstaining.

This means homeowners in Montgomery with properties valued at $900,000 will see a net tax adjustment of $214, after a $593 budget-related increase is offset by $379 in expiring debt savings.

Photo Credit: Nicholas Mistretta/headlinenewsmontgomery.com